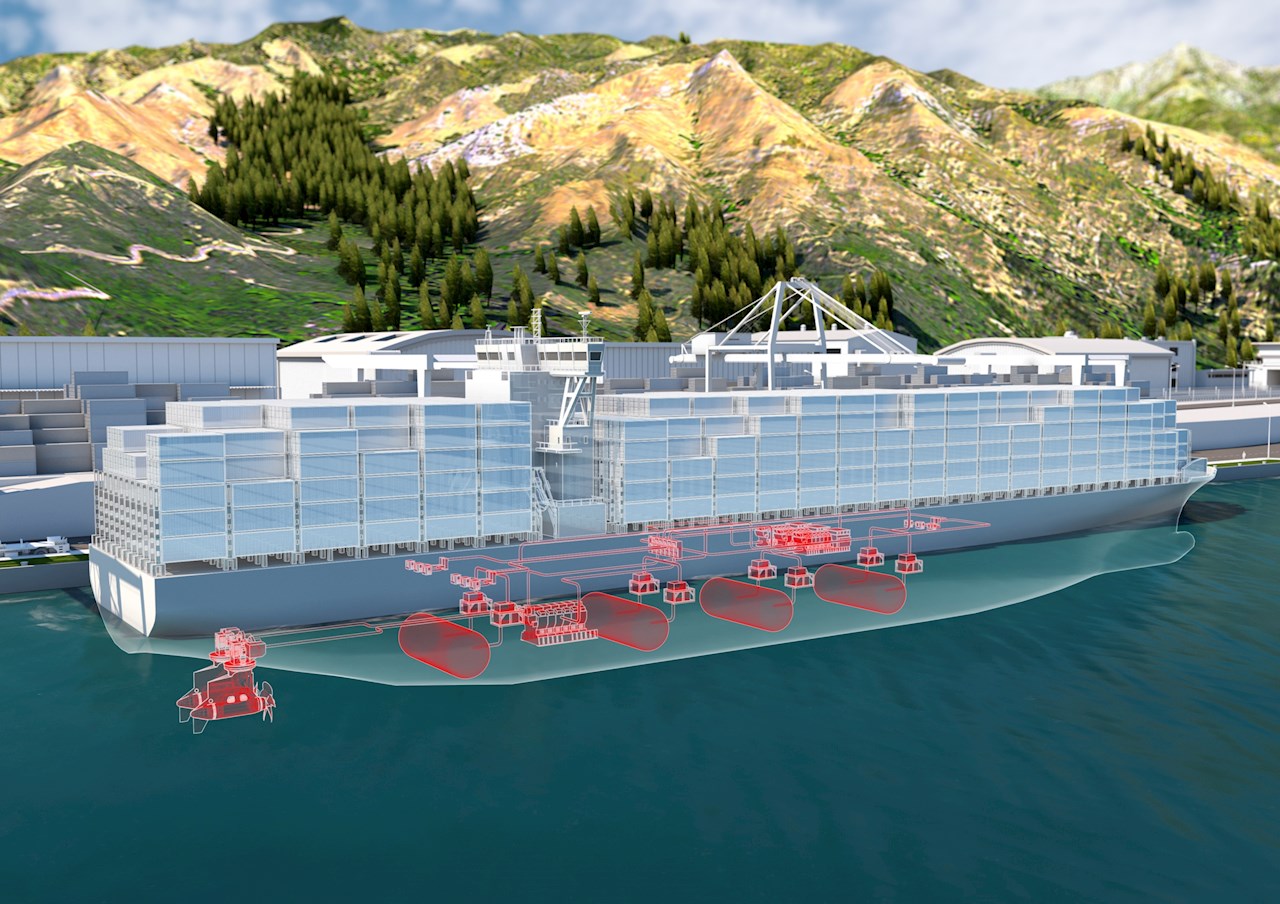

European logistics company Samskip has selected Norwegian Hydrogen as its preferred supplier of liquid green hydrogen for two SeaShuttle container vessels currently under construction. The vessels will operate the world’s first hydrogen-powered container shipping route between Rotterdam and Oslo, breaking the classic “chicken-and-egg” deadlock that has constrained the hydrogen economy. With Norwegian Hydrogen’s Rjukan plant securing EUR 31.5 million from the EU Innovation Fund and NOK 100 million in domestic support, hydrogen deliveries are expected to begin in 2028.

World’s First Hydrogen Container Ships Find Their Fuel Source

The Memorandum of Understanding signed on December 5, 2025, resolves a critical uncertainty for Samskip’s pioneering SeaShuttle vessels: where the hydrogen will come from. While shipbuilders can construct hydrogen-powered vessels and classification societies can certify them, the infrastructure for producing, liquefying, storing, and bunkering hydrogen at scale has lagged behind ship development. This agreement synchronizes vessel delivery with fuel supply readiness—both targeting operational capability by 2028.

Samskip’s investment reflects its ambitious climate commitments. The company recently achieved verification of its “Net-Zero by 2040” target from the Science-Based Targets initiative and received the EcoVadis Platinum medal, ranking in the top 1% for sustainability performance in 2024. The SeaShuttle hydrogen conversion, supported by a grant from Norway’s Enova Fund, demonstrates the company’s willingness to accept first-mover risks to achieve deep decarbonization.

The Rotterdam-Oslo Route

The SeaShuttle vessels will operate Samskip’s established Rotterdam-Oslo service, a strategic choice for several reasons. This route exemplifies short-sea shipping—distances where hydrogen’s energy density disadvantages matter less than for transoceanic voyages. The approximately 1,200 km route allows for manageable tank sizes and regular refueling opportunities.

Both Rotterdam and Oslo offer favorable conditions for hydrogen infrastructure development. Rotterdam, Europe’s largest port, has committed to becoming a hydrogen import hub, with multiple projects underway. Oslo, as Norway’s capital and a center of green shipping initiatives, provides supportive regulatory frameworks and public awareness. The route’s predictable schedule—critical for early-stage technology validation—enables systematic data collection on hydrogen consumption, refueling procedures, and operational costs.

Container shipping on this route also serves diverse commercial customers, demonstrating hydrogen’s viability for mainstream logistics rather than niche applications. Success here could accelerate adoption across Samskip’s broader European network.

Norwegian Hydrogen’s Rjukan Facility

The hydrogen supply will come from Norwegian Hydrogen’s liquid hydrogen production plant in Rjukan, Norway—a location with deep historical connections to industrial chemistry and, ironically, to early 20th-century hydrogen production for ammonia synthesis.

Strategic Location

Rjukan sits in Telemark county, a region with abundant hydroelectric power resources. The plant will operate under a long-term power purchase agreement with Tinn Energi & Fiber, ensuring access to renewable electricity—the fundamental requirement for green hydrogen production. Norway’s hydroelectric generation, with exceptionally low carbon intensity (typically <10 g CO2e/kWh), provides one of the world's cleanest electricity sources for electrolysis.

The required grid connection has been secured, and municipal authorities have approved the zoning plan. Norwegian Hydrogen reports being in final phases of selecting suppliers for key equipment, components, and services, suggesting construction will commence shortly.

Funding Structure

The project has assembled substantial financial support from multiple sources:

- EUR 31.5 million from the 2025 EU Innovation Fund – Supporting establishment of the complete value chain for production, distribution, and bunkering of liquefied hydrogen

- EUR 13.2 million from the EU Hydrogen Auction – Covering operating costs, reducing delivered hydrogen prices during the early commercial phase

- NOK 100 million (~EUR 8.5 million) from Innovation Norway – Combination of grants and green loans for project development

This funding diversification—combining capital grants, operational subsidies, and concessional financing—addresses different risk categories. Capital grants reduce upfront investment requirements, operational subsidies enable competitive pricing during market development, and green loans provide flexible financing for working capital and contingencies.

The total support package approaches EUR 53 million (approximately USD 58 million), representing substantial public investment in establishing Norway’s first complete maritime liquid hydrogen value chain.

Production Capacity and Technology

While Norwegian Hydrogen hasn’t disclosed precise production capacity, the project is described as “right-sized” for early adopters. Industry sources suggest the facility will likely produce 5-10 tonnes of liquid hydrogen per day initially, sufficient to supply multiple vessels including the two Samskip SeaShuttles while allowing for additional customers in maritime, industrial, and other sectors.

Hydrogen production will use water electrolysis powered by renewable electricity. The plant will include liquefaction capability—a critical and energy-intensive step consuming approximately 30-35% of hydrogen’s energy content but essential for marine applications where volumetric energy density matters. On-site liquefaction eliminates transportation logistics for gaseous hydrogen and enables direct loading onto vessels.

Breaking the Chicken-and-Egg Deadlock

The agreement addresses what Norwegian Hydrogen CEO Jens Berge calls the hydrogen economy’s “classic chicken-and-egg dilemma”: lack of demand hinders investment in production, while lack of supply discourages demand creation.

Samskip’s commitment provides Norwegian Hydrogen with demand certainty, enabling final investment decisions. Conversely, Norwegian Hydrogen’s secured funding and advanced project status gives Samskip confidence their vessels won’t face fuel supply disruptions. The MoU formalizes this mutual dependency, allowing both parties to proceed with substantial capital commitments.

This dynamic mirrors successful infrastructure transitions historically. Natural gas vehicle adoption accelerated when fleet operators and fuel suppliers coordinated investments. Electric vehicle deployment required simultaneous buildout of charging networks and vehicle production. Hydrogen shipping faces similar coordination challenges, but at higher stakes given the specialized infrastructure requirements.

Why This Matters

Why This Matters

For Short-Sea Shipping Decarbonization: Container shipping accounts for significant European maritime emissions. If Samskip successfully demonstrates hydrogen-powered container operations, it validates the technology for dozens of similar routes across Europe. The North Sea, Baltic Sea, and Mediterranean all feature short-sea routes where hydrogen could compete effectively with diesel or LNG.

For Hydrogen Infrastructure Development: The Rjukan facility creates a template for maritime hydrogen production combining optimal renewable electricity access, liquefaction capability, and multi-modal distribution. Success here could accelerate similar projects in other hydropower-rich regions: Canada, Iceland, Scotland, New Zealand, or South America’s Patagonia region.

For First-Mover Advantage: Samskip’s commitment positions the company to capture premium pricing from environmentally conscious shippers, potentially securing long-term contracts with customers facing supply chain emission reduction mandates. As EU carbon regulations tighten, zero-emission shipping capacity will command premium rates.

For Risk Mitigation Strategy: Securing a preferred supplier relationship, rather than depending on spot markets, protects Samskip from potential hydrogen price volatility and supply constraints as the market develops. The MoU likely includes provisions ensuring supply continuity and price certainty.

For Norway’s Hydrogen Strategy: This project anchors Norway’s position as a European hydrogen exporter, leveraging abundant renewable electricity and existing maritime expertise. Success could spawn additional facilities, creating an export industry complementing Norway’s traditional oil and gas sector as it declines.

Broader Implications

This agreement exists within a broader European hydrogen ecosystem rapidly taking shape:

- Multiple shipping companies are developing hydrogen vessel projects: ferry operators in Scandinavia, offshore service vessels in Norway, and passenger vessels across Europe

- Port authorities in Rotterdam, Oslo, Hamburg, Antwerp, and elsewhere are planning hydrogen infrastructure as part of decarbonization strategies

- Equipment manufacturers are scaling production of electrolyzers, fuel cells, cryogenic systems, and bunkering equipment

- Energy companies are developing renewable electricity projects explicitly dedicated to hydrogen production

- Classification societies have published rules and guidelines for hydrogen-fueled vessels, enabling design approvals

The Samskip-Norwegian Hydrogen agreement demonstrates that these parallel developments are converging toward operational systems. Each successful project reduces risk perceptions, generates operational data, and builds confidence for subsequent investments.

Quotes from Leadership

“Our partnership with Norwegian Hydrogen marks an important step on our journey towards Net-Zero emissions by 2040,” stated Ólafur Orri Ólafsson, CEO of Samskip. “Hydrogen is a critical enabler for deep decarbonization in short-sea shipping, and Norwegian Hydrogen has demonstrated the capability and commitment needed to support our ambition. Together, we are not only preparing the energy supply for our SeaShuttle vessels, we are also helping accelerate the transition to sustainable logistics across Europe.”

“We are deeply grateful for Samskip’s support and first-mover determination, leading the way in decarbonising short-sea container shipping,” responded Jens Berge, CEO of Norwegian Hydrogen. “It is reassuring to see that our efforts to create a project that meets Samskip’s requirements are now yielding tangible results, enabling Samskip to proceed exclusively with us from this point. Right-sized and with all critical elements in place, the Rjukan LH2 project is ideally positioned for delivery of liquid green hydrogen to early adopters within maritime, industry, and other sectors, covering a large geographical area at a highly attractive price point.”

Project Summary

| Element | Details |

|---|---|

| Customer | Samskip (European logistics company) |

| Supplier | Norwegian Hydrogen AS |

| Vessels | Two SeaShuttle container vessels (under construction) |

| Route | Rotterdam, Netherlands ↔ Oslo, Norway (~1,200 km) |

| Fuel Type | Liquid green hydrogen (LH2) from renewable electrolysis |

| Production Site | Rjukan, Telemark, Norway |

| Power Source | Norwegian hydroelectricity (Tinn Energi & Fiber) |

| EU Innovation Fund | EUR 31.5 million (value chain development) |

| EU Hydrogen Auction | EUR 13.2 million (operating costs) |

| Innovation Norway | NOK 100 million (~EUR 8.5 million, grants + green loans) |

| Norwegian Enova Fund | Grant supporting vessel conversion (amount not disclosed) |

| Expected Operations | 2028 |

| Status | MoU signed December 5, 2025; exclusive supplier relationship |

Looking Ahead

The Samskip-Norwegian Hydrogen partnership represents more than two companies agreeing to a fuel supply contract. It demonstrates that the maritime hydrogen economy is transitioning from concept to implementation, with real vessels, real production facilities, and real commercial operations approaching.

Success will depend on execution—building plants on schedule and budget, commissioning vessels successfully, establishing safe and efficient bunkering procedures, and demonstrating acceptable operational economics. But the fundamentals appear sound: strong corporate commitments backed by substantial public funding, favorable renewable electricity access, suitable routes for early adoption, and supportive regulatory frameworks.

If the SeaShuttles operate successfully from 2028 onward, expect announcements of additional hydrogen container vessels, expansion of production capacity at Rjukan and other sites, and growing confidence among shipowners and fuel suppliers that hydrogen shipping has moved from possibility to reality.

The chicken-and-egg deadlock is breaking. Now comes the harder part: proving it works.

Sources

- Norwegian Hydrogen AS. (2026). “Samskip moves forward with Norwegian Hydrogen as its preferred supplier of liquid green hydrogen.” Press release, January 7, 2026.

- Norwegian Hydrogen AS. (2025). “More support for Rjukan liquid hydrogen project with EUR 31.5 million grant from EU Innovation Fund.” Press release, November 3, 2025.

- Norwegian Hydrogen AS. (2025). “Double win for Norwegian Hydrogen at Rjukan with funding offers from both the EU Hydrogen Bank and Innovation Norway.” Press release, May 20, 2025.

- Samskip corporate communications, December 2025.