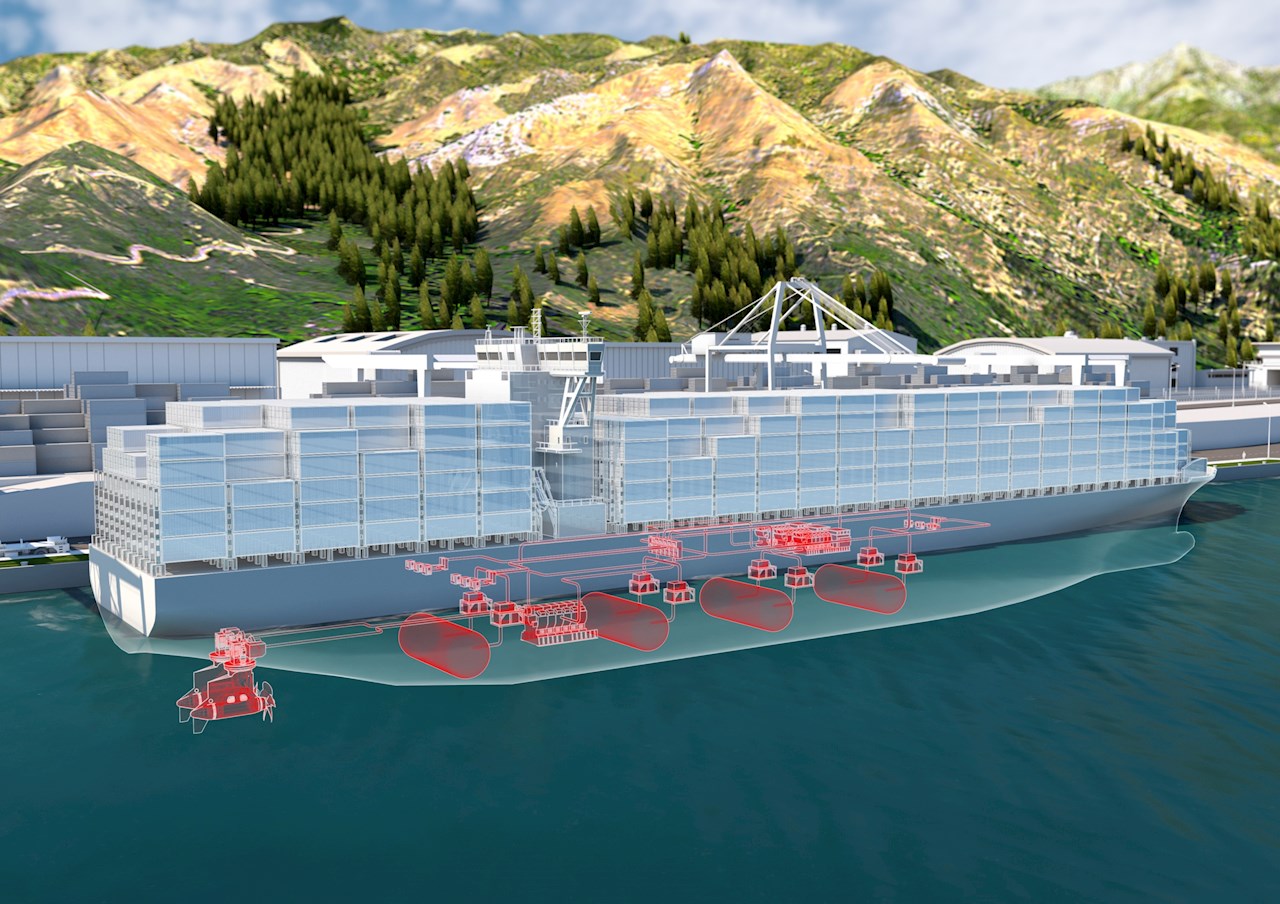

Kawasaki Heavy Industries has signed a contract with Japan Suiso Energy to construct the world’s largest liquefied hydrogen carrier, featuring a cargo capacity of 40,000 cubic meters. This vessel represents a 32-fold increase over the company’s pioneering Suiso Frontier, marking a critical transition from demonstration projects to commercial-scale hydrogen transport. Scheduled for ocean trials by 2030, the carrier will demonstrate the technical and economic feasibility of large-scale hydrogen shipping as Japan advances toward its carbon-neutral goals.

Source: Kawasaki Heavy Industries

From Demonstration to Commercial Scale

The leap from Kawasaki’s 1,250-cubic-meter Suiso Frontier—completed in 2021 as the world’s first liquefied hydrogen carrier—to this 40,000-cubic-meter vessel demonstrates the rapid progression of hydrogen shipping technology. This new carrier will be built at Kawasaki Heavy Industries’ Sakaide Works in Kagawa Prefecture as part of Japan’s New Energy and Industrial Technology Development Organization (NEDO) Green Innovation Fund Project.

Japan Suiso Energy, serving as project operator for NEDO, aims to conduct comprehensive demonstrations of ship-to-shore loading and unloading operations by fiscal year 2030. The project will test operational performance, safety, durability, reliability, and crucially, economic feasibility for large-scale hydrogen transport—information essential for establishing commercial viability.

Technical Innovation for Cryogenic Cargo

Transporting liquefied hydrogen presents unique engineering challenges. At -253°C, liquid hydrogen requires specialized containment systems and handling procedures far more demanding than conventional cryogenic cargoes like LNG.

Cargo Containment System

The vessel’s cargo tanks total approximately 40,000 cubic meters and incorporate high-performance insulation systems designed to minimize boil-off gas generated by natural heat ingress. Managing boil-off is critical for long-distance transport—hydrogen’s extremely low boiling point means even minimal heat transfer causes evaporation. The insulation system must maintain cryogenic temperatures throughout voyages potentially lasting weeks.

Unlike LNG carriers where boil-off rates of 0.10-0.15% per day are standard, liquid hydrogen faces steeper challenges. The Suiso Frontier demonstrated boil-off rates around 0.2-0.3% per day, and this larger vessel aims to improve on these figures through advanced vacuum-jacketed tank technology.

Dual-Fuel Propulsion

The carrier will feature a diesel and hydrogen-fueled electric propulsion system, combining hydrogen- and oil-based dual-fuel generator engines with conventional oil-fired generators. This hybrid approach offers operational flexibility while reducing carbon emissions.

Significantly, boil-off gas from the cargo tanks can be compressed, heated, and reused as fuel for propulsion. This not only reduces CO2 emissions but also addresses the economic and environmental cost of venting hydrogen—a solution that transforms a liability into an asset. This capability is particularly relevant given hydrogen’s global warming potential (11.6 kg CO2e per kg H2 over 100 years), making venting environmentally undesirable.

Cargo Handling Infrastructure

The vessel will be equipped with a cargo handling system capable of loading and unloading large volumes of liquefied hydrogen using double-wall vacuum-jacketed piping. These transfer systems maintain extremely low temperatures during operations between shore facilities and onboard tanks, preventing heat ingress that would cause excessive boil-off.

The carrier will operate in conjunction with a liquefied hydrogen terminal under construction at Ogishima in Kawasaki City, forming an integrated supply chain infrastructure for demonstration purposes.

Optimized for Hydrogen’s Unique Properties

Liquid hydrogen’s extremely low density—approximately 71 kg/m³ compared to LNG’s 450 kg/m³—fundamentally affects vessel design. The hull form and draft have been specifically optimized to reflect this characteristic, improving propulsion efficiency and reducing power requirements.

This density difference means that for equivalent energy content, hydrogen requires significantly more volume than other marine fuels. The 40,000 m³ capacity translates to approximately 2,840 tonnes of liquid hydrogen—roughly equivalent in energy terms to 7,800 tonnes of LNG, yet requiring more than five times the volume.

Safety and Risk Management

Hydrogen’s wide flammability range (4-75% in air, compared to 5-15% for natural gas) and low ignition energy demand rigorous safety protocols. The vessel’s hydrogen fuel, supply, and cargo handling systems have undergone comprehensive risk assessment, with multiple safety measures incorporated to protect crew, environment, and vessel structure.

ClassNK, the classification society, will oversee compliance with safety standards. The vessel will be registered in Japan, operating under Japanese maritime regulations for hydrogen transport—a regulatory framework still evolving as the technology matures.

Specifications at a Glance

- Length Overall: Approximately 250 meters

- Molded Breadth: 35 meters

- Fully Loaded Draft: 8.5 meters (summer)

- Cargo Capacity: 40,000 cubic meters (~2,840 tonnes liquid hydrogen)

- Service Speed: Approximately 18 knots

- Propulsion: Diesel and hydrogen dual-fuel electric system

- Cargo Containment: High-performance insulated cryogenic tanks

- Classification: ClassNK

- Flag: Japan

- Builder: Kawasaki Heavy Industries, Sakaide Works

- Expected Completion: By fiscal year 2030 (demonstration trials)

Strategic Context: Japan’s Hydrogen Economy

This carrier serves as a cornerstone for Japan’s hydrogen strategy, which anticipates significant global hydrogen demand in the 2030s. Japan has committed to achieving carbon neutrality by 2050 and views hydrogen as essential for decarbonizing power generation, mobility, and industrial sectors—applications where electrification faces technical or economic limitations.

The vessel enables what Japan cannot produce domestically at sufficient scale: low-cost renewable hydrogen. By importing hydrogen produced using abundant renewable electricity from regions like Australia, the Middle East, or potentially Europe, Japan can access competitively priced clean energy despite limited domestic renewable resources.

This strategy aligns with findings from recent European Commission research showing that shipping liquid hydrogen emerges as one of the most cost-effective and environmentally sustainable options for long-distance hydrogen transport, particularly compared to chemical carriers like ammonia or methanol which require energy-intensive conversion processes.

Economic Viability Questions

While technical feasibility has been demonstrated through the Suiso Frontier project, economic viability remains uncertain. Key cost drivers include:

- Liquefaction costs: Consuming approximately 30-35% of hydrogen’s energy content

- Specialized infrastructure: Cryogenic storage, handling equipment, and dedicated terminals

- Boil-off losses: Even with improved insulation, some hydrogen will be lost

- Vessel capital costs: Specialized materials and systems increase construction costs

- Scale requirements: Economic efficiency improves dramatically with larger vessels and higher utilization

The 2030 demonstration will provide critical data on these factors. Current estimates suggest delivered hydrogen costs could range from €4-6 per kilogram for long-distance shipping, depending on production costs, utilization rates, and infrastructure amortization.

Why This Matters

Why This Matters

For Global Hydrogen Markets: This vessel demonstrates that liquid hydrogen shipping can scale to commercial volumes. The 40,000 m³ capacity—sufficient to transport approximately 2,840 tonnes per voyage—enables economically viable international trade. Multiple such vessels could deliver millions of tonnes annually, matching planned production and demand scenarios for the 2030s.

For Maritime Decarbonization: The dual-fuel propulsion system showcasing hydrogen as a marine fuel validates one pathway for shipping’s own decarbonization. By 2030, this carrier will provide operational data on hydrogen’s performance, reliability, and safety as a marine fuel under commercial conditions—information crucial for wider adoption.

For Energy Security: Countries lacking domestic renewable resources can access global hydrogen markets, diversifying energy supply and reducing dependence on fossil fuel imports. Japan’s investment in this infrastructure reflects a strategic bet on hydrogen as a pillar of future energy security.

For Industrial Decarbonization: Heavy industries—steel, chemicals, cement—require high-temperature heat and chemical reducing agents that electricity cannot easily provide. Large-scale hydrogen imports make decarbonization of these sectors technically and economically feasible in regions without domestic production capacity.

For Innovation Spillover: Technologies developed for liquid hydrogen shipping—ultra-high-performance insulation, cryogenic handling systems, dual-fuel engines—have applications across the broader cryogenic industry, from LNG to industrial gases.

Challenges Ahead

Despite this progress, significant hurdles remain:

Infrastructure Development: Establishing a commercial hydrogen supply chain requires coordinated investment in production facilities, liquefaction plants, storage terminals, and distribution networks—a chicken-and-egg challenge requiring billions in capital before revenue flows.

Cost Competitiveness: Hydrogen must compete with established energy carriers. Even with carbon pricing, delivered costs need to decline substantially to be economically attractive for most applications.

Regulatory Framework: International regulations for hydrogen shipping remain under development. The International Maritime Organization (IMO) aims to finalize hydrogen-specific regulations by 2028, but gaps persist regarding classification, port state control, and emergency response protocols.

Safety Perception: Public and industry acceptance of hydrogen transport through populated port areas requires demonstrating robust safety records and incident response capabilities.

Scale-Up Timeline: Even successful 2030 demonstrations won’t immediately translate to commercial deployment. Building fleets, establishing supply chains, and achieving operational optimization will require years of additional investment and learning.

Competitive Landscape

Kawasaki’s leadership position faces potential competition. European shipbuilders are exploring similar technologies, and China has announced plans for large-scale hydrogen carriers. However, Kawasaki’s first-mover advantage—demonstrated through the Suiso Frontier—provides valuable operational experience and intellectual property.

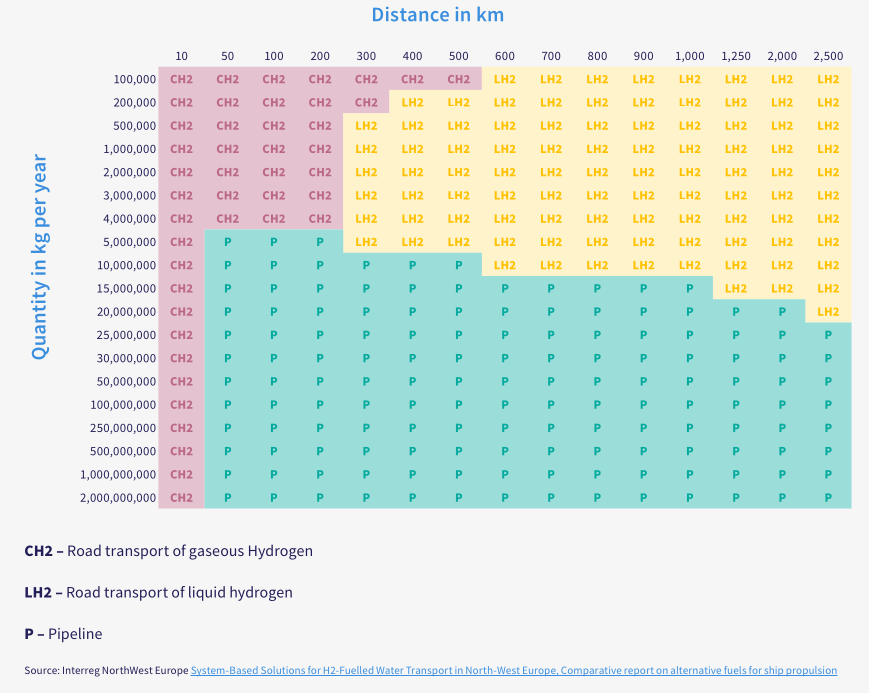

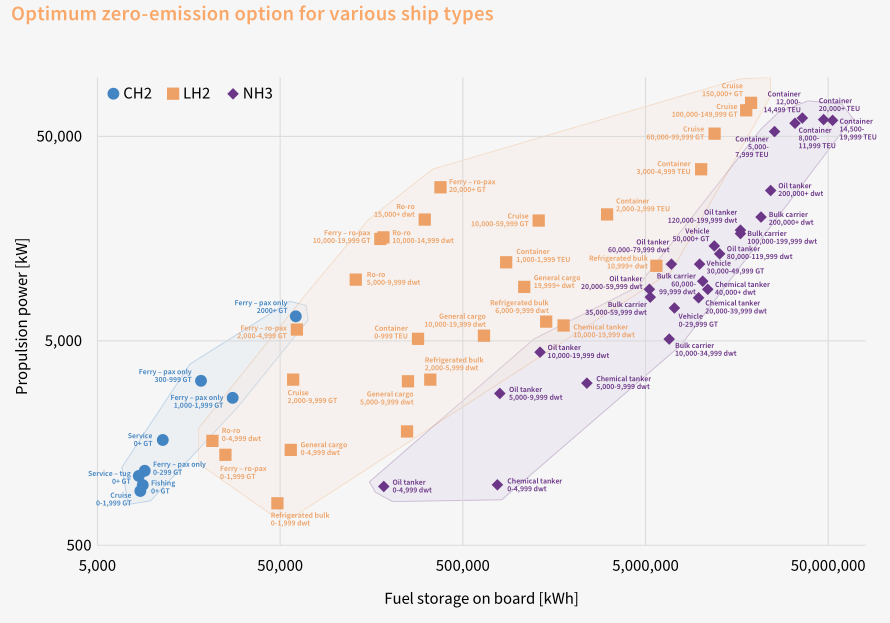

The vessel also competes with alternative hydrogen carriers. Ammonia shipping benefits from existing infrastructure and lower containment costs, though it requires energy-intensive conversion at both ends. LOHCs (Liquid Organic Hydrogen Carriers) offer ambient-temperature handling but face even higher conversion energy penalties. Compressed hydrogen pipelines remain competitive for shorter distances within continental regions.

Recent European research suggests liquid hydrogen shipping and compressed hydrogen pipelines offer the best balance of cost and environmental performance for long-distance transport, supporting Kawasaki’s strategic direction.

Timeline and Next Steps

Construction at Sakaide Works will occur over the next several years, with ocean-going trials scheduled by fiscal year 2030. The demonstration phase will evaluate:

- Loading and unloading procedures at commercial scale

- Boil-off management during extended voyages

- Dual-fuel propulsion system performance and reliability

- Maintenance requirements and operational costs

- Safety protocols and emergency procedures

- Environmental performance including CO2 emissions reduction

Success in these demonstrations could trigger orders for commercial vessels in the early 2030s, with full-scale deployment potentially beginning mid-decade. Japan Suiso Energy and NEDO will share findings with industry stakeholders to accelerate commercialization.

Conclusion

Kawasaki’s 40,000 cubic meter liquefied hydrogen carrier marks a pivotal moment in maritime hydrogen transport. While technical challenges remain and economic viability requires demonstration, the project represents the most ambitious effort yet to establish commercial-scale hydrogen shipping infrastructure.

The vessel’s success or failure will significantly influence global hydrogen strategies. Positive results could accelerate international hydrogen trade, enabling countries to access competitively priced renewable hydrogen regardless of domestic resource constraints. Challenges or cost overruns might redirect investment toward alternative carriers or regional pipeline networks.

What’s certain is that large-scale hydrogen transport will be essential for global decarbonization. Whether liquid hydrogen shipping emerges as the dominant pathway depends largely on how well vessels like this perform when the real testing begins in 2030.

Sources

- Maritime Activity Reports, Inc. (2026). “Kawasaki Heavy Industries to Build World’s Largest Liquefied Hydrogen Carrier.” Marine Link, January 6, 2026.

- Kawasaki Heavy Industries official announcement, January 2026.

- Japan Suiso Energy / NEDO Green Innovation Fund Project documentation.

- Arrigoni, A., D’Agostini, T., Dolci, F., & Weidner, E. (2025). “Techno-economic and life-cycle assessment comparisons of hydrogen delivery options.” Frontiers in Energy, 19(6): 1129-1142.