As ship operators grapple with mounting environmental regulations and the global push towards decarbonization, hydrogen has emerged as a promising alternative fuel. Its potential to drastically reduce greenhouse gas emissions makes it an attractive option for shipowners seeking sustainable solutions. However, transitioning to hydrogen is not a straightforward process. This deep-dive explores key aspects of hydrogen integration in shipping, providing technical insights for professionals in the field.

Chapter 1: Understanding Hydrogen as a Marine Fuel

Hydrogen offers several forms of application in maritime settings: compressed hydrogen, liquefied hydrogen, and hydrogen carriers such as ammonia or methanol. Each form has unique implications for ship design and operation.

Compressed Hydrogen

Compressed hydrogen is stored under high pressure (typically 350-700 bar). While it avoids the need for cryogenic systems, its low energy density compared to liquefied hydrogen results in larger storage requirements. High-pressure systems also introduce significant safety risks due to the potential for leaks at multiple connection points and fittings. Hydrogen’s small molecular size increases the likelihood of escaping through seals and joints, necessitating meticulous design and maintenance of piping and storage systems. This makes compressed hydrogen suitable for short-sea vessels with space to accommodate the necessary storage tanks, provided that safety measures are rigorously implemented. Typically, hydrogen bottles are stored on the open deck, either in fixed installations or in swappable modules that can be replaced efficiently in port, offering flexibility for refueling operations while minimizing turnaround times.

Liquefied Hydrogen

Liquefied hydrogen, stored at -253°C, offers a higher energy density but requires complex cryogenic insulation and specialized materials to prevent boil-off. Cryogenic tanks also present design challenges, particularly in integrating these systems into existing hull geometries without compromising structural integrity. Additionally, the hydrogen supply chain for maritime applications is still in its early stages, with only a few specialized suppliers currently available. This limited supply base, combined with the lack of established cases in maritime applications, underscores the pioneering nature of adopting liquefied hydrogen as a marine fuel.

Hydrogen Carriers

Hydrogen can be chemically bonded in ammonia or methanol. These carriers simplify storage and handling but require onboard conversion systems (e.g., cracking or reforming) to extract hydrogen, adding complexity and reducing overall efficiency. For example, cracking ammonia into hydrogen and nitrogen requires significant energy, typically consuming 20-30% of the hydrogen’s energy content. Similarly, reforming methanol to produce hydrogen involves thermal processes that result in energy losses of around 15-25%. These inefficiencies reduce the overall energy available for propulsion or onboard systems, making the use of hydrogen carriers less efficient compared to direct storage of compressed or liquefied hydrogen. This approach is gaining traction for deep-sea applications due to the longer range and existing bunkering infrastructure.

Fuel Cells vs. Combustion

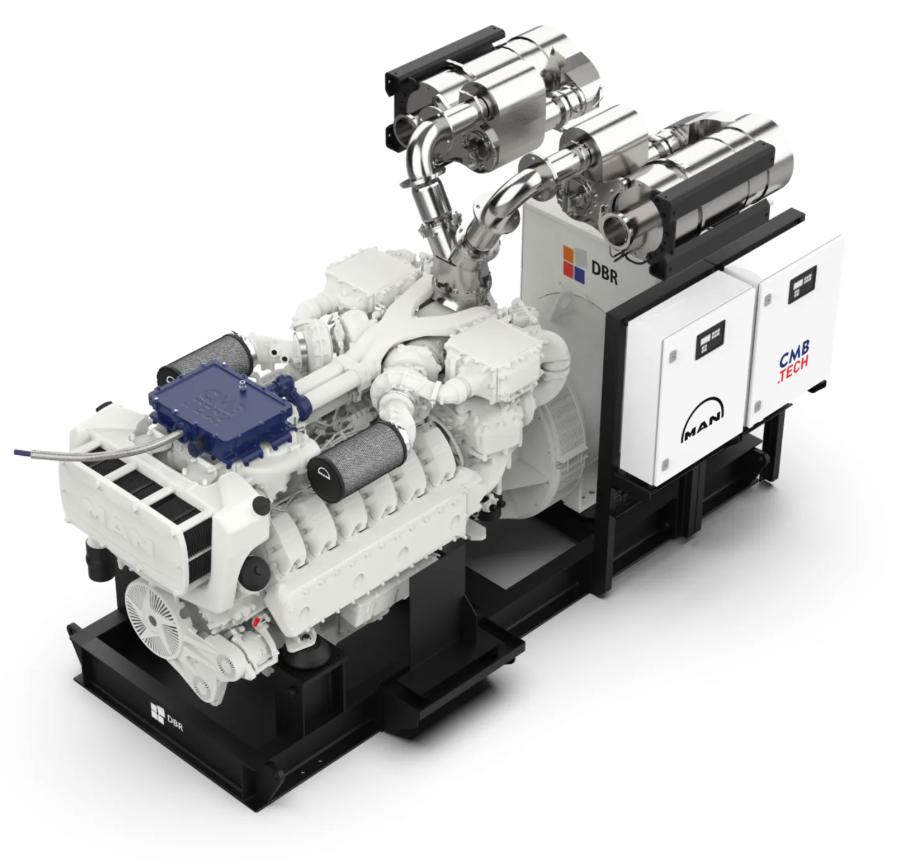

Fuel cells offer high efficiency and zero direct emissions, making them ideal for environmentally sensitive areas. Internal combustion engines, modified for hydrogen, provide a transitional solution but still emit nitrogen oxides (NOx), which are harmful pollutants contributing to air quality degradation and acid rain. These emissions necessitate additional control systems such as Selective Catalytic Reduction (SCR) units to mitigate their environmental impact. The presence of NOx also highlights the need for continued innovation in hydrogen combustion technology to reduce or eliminate these emissions entirely.

Carnot engines, which operate based on the thermodynamic Carnot cycle, offer a theoretical pathway to achieving higher efficiencies in energy conversion processes. By utilizing hydrogen in a Carnot engine configuration, heat energy can be converted to mechanical work with minimal losses. While still in the conceptual or experimental phase for maritime applications, Carnot-based hydrogen engines could potentially revolutionize ship propulsion systems by maximizing fuel efficiency and further reducing emissions.

The Different Colors of Hydrogen

- Green Hydrogen: Produced through electrolysis using renewable energy like wind or solar power, achieving nearly zero well-to-wake emissions when the electricity source is fully renewable.

- Blue Hydrogen: Derived from natural gas via steam methane reforming (SMR) with carbon capture and storage (CCS). Well-to-wake emissions are 50-60% lower than grey hydrogen, depending on CCS efficiency.

- Grey Hydrogen: Produced via SMR without CCS, resulting in 9-10 kg of CO₂ emissions per kg of hydrogen.

- Brown and Black Hydrogen: Created from coal or lignite gasification, generating more than 20 kg of CO₂ emissions per kg of hydrogen.

- Pink Hydrogen: Produced using electrolysis powered by nuclear energy, resulting in low well-to-wake emissions, contingent on nuclear fuel cycle efficiency.

- Orange Hydrogen: Generated via electrolysis using grid electricity, with well-to-wake emissions dependent on the specific renewable-to-fossil fuel ratio in the energy mix.

Chapter 2: Regulatory and Policy Drivers

The regulatory landscape is a key driver for hydrogen adoption in maritime industries because it compels shipowners to comply with strict emissions reduction targets and incentivizes the adoption of low-carbon technologies. Regulations such as those under the International Maritime Organization (IMO) directly enforce environmental standards, making hydrogen an attractive solution to meet decarbonization goals while ensuring fleet competitiveness in a rapidly evolving market.

IMO’s Decarbonization Targets

The International Maritime Organization (IMO) aims to cut greenhouse gas emissions by 50% by 2050 compared to 2008 levels. Hydrogen, as a zero-emission fuel, aligns closely with these goals. Future amendments to MARPOL Annex VI are expected to favor hydrogen technologies, with discussions underway to incorporate lifecycle carbon assessments for marine fuels. IMO’s Energy Efficiency Existing Ship Index (EEXI) and Carbon Intensity Indicator (CII) already encourage the use of alternative fuels by penalizing less efficient vessels. These measures are expected to evolve further, offering clear pathways for hydrogen to play a central role in maritime decarbonization. Collaboration with classification societies and compliance with forthcoming IMO guidelines will be critical for shipowners transitioning to hydrogen.

EU Initiatives

The European Union’s “Fit for 55” initiative mandates a 55% reduction in greenhouse gas emissions by 2030. The inclusion of maritime emissions in the EU Emissions Trading System (ETS) will financially penalize high-emission vessels, incentivizing hydrogen adoption. The EU ETS (Emissions Trading System) requires shipping companies to purchase allowances for their CO₂ emissions, creating a financial incentive to reduce emissions or transition to low-emission fuels like hydrogen. The “FuelEU Maritime” initiative complements this by mandating a gradual reduction in the greenhouse gas intensity of marine fuels, effectively setting a pathway for zero-emission fuels to become the standard. Together, these measures push shipowners toward adopting hydrogen to meet compliance and avoid escalating costs.

Subsidies and Incentives

Several governments offer grants and subsidies for hydrogen-fueled vessels. For example, Norway’s ENOVA scheme supports the development of hydrogen vessels, having awarded over NOK 1.5 billion in 2024 to various hydrogen-related maritime projects. This substantial funding underscores Norway’s commitment to accelerating the transition to sustainable shipping technologies. while the EU’s Horizon 2020 program funds research into hydrogen technologies. Shipowners should actively pursue such opportunities to offset high initial costs. Additionally, the EU Innovation Fund provides substantial financial support for large-scale projects focused on low-carbon technologies, including hydrogen-powered vessels. This fund is designed to accelerate the deployment of innovative technologies, making it a valuable resource for shipowners aiming to transition to hydrogen while mitigating financial risks. In addition to EU-level initiatives, national governments often provide subsidies tailored to their domestic shipping sectors. These can include tax incentives, grants, and funding for research and development projects, offering further opportunities to reduce the financial burden of adopting hydrogen technologies.

Chapter 3: Key Challenges of Transitioning to Hydrogen

Transitioning to hydrogen presents several technical and economic challenges. Shipowners must address these to ensure feasibility and reliability.

IMO Rules on Hydrogen as Fuel

A significant challenge for hydrogen adoption is the absence of specific IMO rules governing its use as a marine fuel. While the IMO has developed regulations for alternative fuels like LNG under the IGF Code (International Code of Safety for Ships Using Gases or Other Low-Flashpoint Fuels), hydrogen is not yet explicitly covered. This regulatory gap creates uncertainty for shipowners and complicates the approval process for hydrogen-powered vessels. Shipowners must rely on interim guidance and classification societies to navigate these challenges until comprehensive IMO rules are established.

Infrastructure Gaps

Hydrogen bunkering infrastructure is in its infancy, compounded by the limited and geographically concentrated green hydrogen production capacity. Major production hubs are located in regions with abundant renewable energy resources, such as Northern Europe, the Middle East, and Australia. For instance, Germany hosts facilities like the Heide Refinery, which integrates green hydrogen into industrial applications, while Norway’s “Hydrogen Valley” focuses on maritime hydrogen solutions. In Australia, the Port of Newcastle is developing large-scale export facilities to supply Asia and Europe, and Japan’s Kawasaki Heavy Industries operates one of the world’s first liquefied hydrogen production sites in Kobe, emphasizing its use in maritime and energy sectors.

This limited production network poses logistical challenges, as hydrogen bunkering facilities along global shipping routes remain sparse. For example, liquefied hydrogen transport necessitates advanced cryogenic systems, while compressed hydrogen requires high-pressure refueling systems, both of which are still underdeveloped. The need for infrastructure is critical to support the anticipated growth in hydrogen-powered shipping. Shipowners can engage in partnerships with ports to accelerate the deployment of these systems, which include safe cryogenic handling for liquefied hydrogen and robust setups for high-pressure compressed hydrogen storage. Close collaboration between stakeholders can facilitate the development of consistent refueling points and reduce operational uncertainties for hydrogen-powered vessels.

Storage Requirements

Hydrogen’s lower volumetric energy density compared to conventional fuels necessitates larger tanks, reducing cargo capacity. To illustrate this:

- Compressed Hydrogen (CH₂): The energy density of compressed hydrogen at 350 bar is approximately 5.6 MJ/L (or 5,600 MJ/m³). To replace 1 ton of heavy fuel oil (HFO), which contains approximately 40,200 MJ of energy, approximately 7.18 m³ of compressed hydrogen are required. This equates to a significant storage volume, necessitating optimized tank arrangements. This storage is typically managed using bottles, which are inherently space-inefficient, further complicating the integration of hydrogen systems into vessel designs.

- Liquefied Hydrogen (LH₂): Liquefied hydrogen has a higher energy density of about 8.5 MJ/L (or 8,500 MJ/m³). For the same 1 ton of HFO equivalent, roughly 4.73 m³ of liquefied hydrogen would be needed. While this reduces the storage volume compared to compressed hydrogen, it requires complex cryogenic systems to maintain the -253°C storage temperature. These cryogenic tanks are typically C-type and cylindrical in shape, designed to handle the extreme thermal and structural stresses associated with liquefied hydrogen storage. Their geometry is optimized for maintaining pressure integrity and minimizing thermal losses, though it can create challenges in efficiently utilizing onboard space.

Innovative tank designs, such as prismatic cryogenic tanks, play a crucial role in optimizing storage while minimizing space loss. However, these systems must carefully balance space efficiency, stringent safety requirements, and advanced thermal management to prevent boil-off and associated energy losses, which are critical for maintaining operational reliability and fuel efficiency.

Cost of Hydrogen

Hydrogen production remains expensive, especially for green hydrogen derived from renewable energy. Blue hydrogen, produced from natural gas with carbon capture, offers a cost-effective alternative but lacks the same environmental benefits. Shipowners must evaluate fuel costs in the context of long-term operational savings.

Green hydrogen is produced via electrolysis, a process where electricity splits water into hydrogen and oxygen using an electrolyzer. This method is most environmentally friendly when powered by renewable energy sources like wind or solar. However, it remains costly due to the high energy requirements and infrastructure expenses. Producing one kilogram of green hydrogen typically requires 50-55 kWh of electricity for production, depending on the efficiency of the electrolyzer. Currently, the cost of green hydrogen ranges between $4 and $6 per kilogram, though regional deviations exist. In areas with abundant and inexpensive renewable energy, such as parts of the Middle East and Australia, costs may approach the lower end of the spectrum. Conversely, in regions where renewable energy is scarce or grid electricity prices are higher, such as parts of Europe and East Asia, costs can exceed $6 per kilogram. For maritime applications, compressed hydrogen (at 350 bar) costs approximately $8-$10 per kilogram with an additional 3-5 kWh needed for compression to 350 bar, while liquefied hydrogen (at -253°C) is even more expensive, ranging from $12 to $14 per kilogram and typically requiring an additional 10-13 kWh per kilogram for the energy-intensive liquefaction process.

Cost of hydrogen equipment

One of the most significant challenges associated with adopting hydrogen as a maritime fuel is the high cost of the required equipment. This includes specialized cryogenic tanks for liquefied hydrogen, or high-pressure storage systems for compressed hydrogen, and advanced fuel cell technologies or engines for power generation. Fuel cells for instance can cost approximately €1,500 per kW. In addition, a backup system based on conventional fossil fuel is often kept on board for sake of redundancy. This further increases the capital expenditure, as shipowners must invest in maintaining both systems. These upfront expenses can deter shipowners from transitioning to hydrogen, especially in the absence of widespread subsidies or incentives to offset these costs. However, ongoing advancements in technology and economies of scale are expected to reduce these costs over time, making hydrogen more accessible for the maritime sector.

Safety Concerns

Hydrogen’s flammability and diffusivity demand rigorous safety measures. Double-walled piping, explosion-proof compartments, and advanced ventilation systems are necessary to mitigate risks. Classification societies provide guidelines, but implementation requires specialized knowledge. This is where a risk-based approach becomes essential. The risk-based approach involves systematically identifying, assessing, and mitigating potential hazards associated with hydrogen systems. It accounts for hydrogen’s unique properties, such as flammability and high diffusivity, and establishes tailored safety measures to address these risks. This method is especially important in the absence of fully developed regulations, allowing shipowners to work closely with classification societies and leverage expert insights to ensure safe and compliant hydrogen adoption.

Chapter 4: Steps for Transitioning to Hydrogen

Feasibility Studies

Conduct comprehensive feasibility studies to assess both the technical and economic aspects of hydrogen integration. This involves a detailed analysis of vessel operating profiles, including energy demand patterns and range requirements, as well as the availability and reliability of hydrogen fuel supply along intended routes. Shipowners must evaluate whether existing or planned bunkering infrastructure can support their operational needs. Additionally, these studies should factor in capital expenditure (CAPEX) and operating expenditure (OPEX) implications, alongside the environmental benefits and compliance with emerging regulations. Engaging multidisciplinary teams with expertise in hydrogen technologies, naval architecture, and supply chain logistics will ensure a holistic assessment.

Retrofit or Newbuild?

Retrofitting existing vessels involves integrating hydrogen storage and fuel systems, which can be challenging but cost-effective for newer ships. Hydrogen-based solutions can also be implemented to power only part of a ship’s total energy requirements, serving as a supplementary source alongside traditional or other alternative fuels. This approach allows for incremental adoption while addressing specific operational needs. New builds, however, can be optimized for hydrogen propulsion, incorporating state-of-the-art technologies.

Collaborative Development

Shipowners should collaborate with technology providers, shipyards, and regulatory bodies. Joint development projects enable cost sharing and access to cutting-edge solutions.

Training and Certification

Crews must undergo specialized training in hydrogen handling and system maintenance. Certification programs from organizations like DNV or Lloyd’s Register ensure adherence to safety standards.

Chapter 5: The Business Case for Hydrogen

Environmental Benefits

Hydrogen-powered ships emit zero CO₂ and significantly reduce other pollutants, such as sulfur oxides (SOx) and particulates. This enhances corporate sustainability credentials, appealing to eco-conscious customers and investors.

Economic Opportunities

While hydrogen systems involve high capital expenditure, they offer long-term savings through improved fuel efficiency and lower emissions-related costs. Zero-emission vessels may also gain preferential treatment in green ports and attract premium cargo rates.

Future Market Competitiveness

Adopting hydrogen early positions shipowners ahead of regulatory trends. As decarbonization mandates tighten, fleets equipped with hydrogen propulsion will maintain operational viability and avoid the risk of stranded assets.

Conclusion

The transition to hydrogen is a complex but rewarding journey for shipowners. By understanding hydrogen’s technical nuances, navigating the regulatory landscape, addressing challenges, and building a robust business case, shipowners can lead the maritime industry into a sustainable future. This series will delve deeper into each of these chapters, providing actionable insights for professionals committed to advancing green shipping.