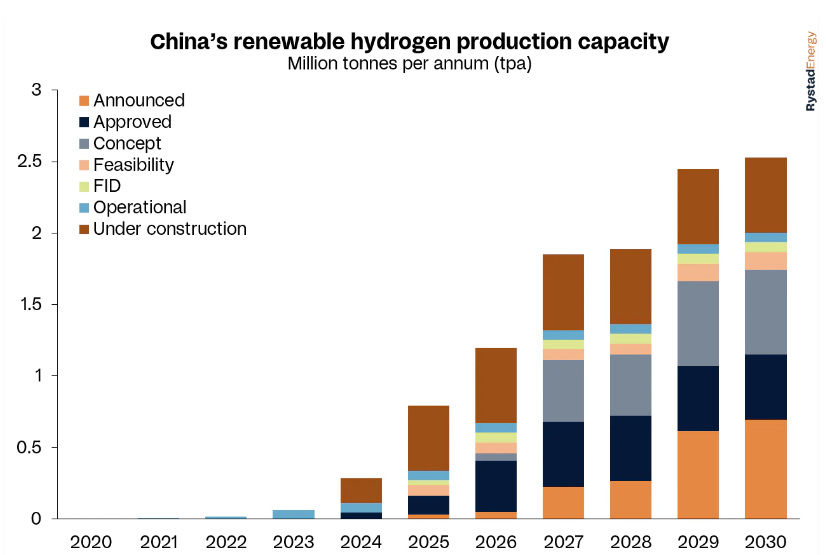

As a maritime enthusiast for hydrogen in shipping, I have lately been disappointed about news related to hydrogen production. lately. China’s recent green hydrogen leap in production, as highlighted by Rystad Energy, are not just national milestones—they have profound implications for the global maritime industry as green hydrogen is required to transition. So next to hydrogen ships, China is also developing here rapidly.

China’s Accelerated Green Hydrogen Production

China is set to surpass its 2025 green hydrogen production target by the end of this year, achieving an annual output of 220,000 tonnes. This rapid advancement is primarily driven by significant investments in electrolyzer capacity and the development of extensive hydrogen infrastructure. Below graph indicates that plans to ramp up production.

Relevance to the Maritime Industry

For the shipping sector transitioning to cleaner fuels is imperative, and green hydrogen emerges as a promising solution. In fact it is the basis for other fuels like green ammonia and methanol. Hydrogen can be directly used in fuel cells to power vessels with zero emissions, producing only water as a byproduct. This technology is especially viable for short-sea shipping and port operations, where refueling infrastructure can be more readily established.

China’s Role in Maritime Decarbonization

China’s leadership in green hydrogen production can significantly influence the maritime industry’s decarbonization efforts. Increased hydrogen availability can reduce costs and encourage the adoption of hydrogen-powered vessels. Moreover, China’s development of hydrogen pipelines, such as the 400-kilometer project by Sinopec, facilitates efficient distribution, potentially supporting maritime refueling stations.

Challenges and the Path Forward

While the prospects are promising, challenges persist. Hydrogen’s low energy density requires larger storage solutions, impacting vessel design. Additionally, establishing a comprehensive refueling infrastructure is crucial for widespread adoption. Collaborative efforts between energy producers, maritime stakeholders, and policymakers are essential to address these hurdles and promote standardization.