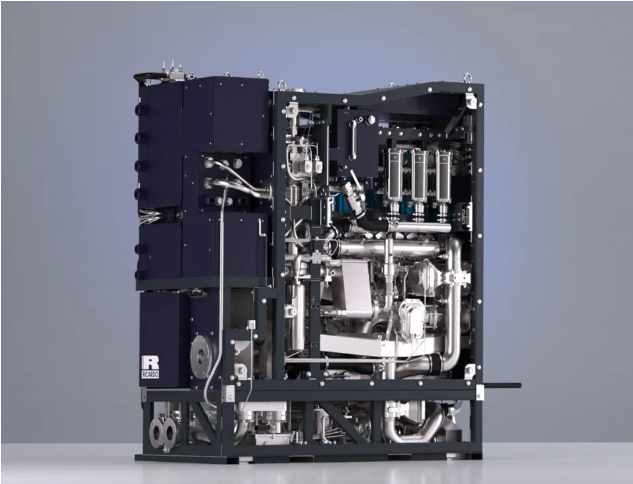

In order to develop hydrogen powered ships we need more development in the different building blocks like the fuel cells. Earlier this month I reported about the Ricardo fuel cell system achieving almost 400 kW output. Now it is great to see that EODEV has obtained Type Approval for its REXH2 fuel cell system. This development fits nicely with EO’s container ship project. The platform is based on the Toyota fuel cell technology. Personally, I have concerns about using automotive technology in shipping, however EODEV surely has taken this into consideration.

A Major Step for Maritime Hydrogen Adoption

The REXH2 fuel cell system, developed by Energy Observer Developments (EODEV), has now achieved Type Approval from Bureau Veritas, a leading classification society. This certification validates the system’s compliance with international safety and performance standards, making it easier for shipbuilders and operators to integrate hydrogen propulsion into new and existing vessels.

Type Approval is a critical process that ensures maritime systems meet stringent regulations before deployment. This milestone means that the REXH2 is recognized as a safe and reliable solution for zero-emission marine power, significantly reducing regulatory hurdles for adoption in commercial shipping, passenger ferries, and even superyachts.

The REXH2: A Proven Solution for Clean Marine Power

The REXH2 is a modular hydrogen fuel cell system designed for maritime applications, offering a scalable and efficient alternative to diesel generators. It has been rigorously tested in real-world conditions aboard the Energy Observer, a pioneering hydrogen-powered vessel that has demonstrated the viability of fuel cell propulsion on long-distance journeys.

Key features of the REXH2 include:

- Modularity – The system can be configured to meet various power demands, making it suitable for different vessel types.

- Zero Emissions – Producing only water and heat as byproducts, the REXH2 aligns with global decarbonization goals.

- Compliance with IMO Regulations – The certification supports the International Maritime Organization’s (IMO) strategy to reduce greenhouse gas (GHG) emissions in shipping.

Implications for the Hydrogen-Powered Shipping Industry

The certification of the REXH2 represents a major leap forward for hydrogen-powered vessels. Until now, the maritime industry has faced significant challenges in adopting hydrogen fuel cells due to regulatory uncertainties and a lack of standardized certification frameworks. With this approval, shipowners and naval architects can integrate hydrogen propulsion with greater confidence, accelerating the transition to clean energy.

This achievement also reinforces EODEV’s position as a leader in maritime hydrogen technology. By securing Type Approval, the company has set a benchmark for other hydrogen fuel cell manufacturers, fostering innovation and investment in the sector.

Future Prospects

For naval architects, shipbuilders, and operators exploring zero-emission solutions, the REXH2 is now a certified and viable option. With increasing pressure to meet sustainability targets, this certification is a game-changer for the future of maritime hydrogen propulsion.